Who doesn’t want money and to be rich?

Even though I’m providing you with this information for free, the truth is that in the real world, everything comes with a price.

The problem isn’t that we all want to be rich; the problem starts when we want to become rich quickly.

To achieve quick wealth, we often start using our minds for dubious things. We search for ways that will give us money as fast as possible, ways that will make us rich quickly.

Not everyone wants to start a business. And is there a guarantee that you’ll be profitable after starting a business?

Some are scared to start from scratch, even after learning high-income skills.

Or they simply don’t have the time because they can’t break free from their daily hectic job life. By the time they get home, their energy is drained.

Many are unhappy with their 9-to-5 jobs, but they continue because they are forced to do so for their daily expenses.

Besides, 9 to 5 is just a saying; with commuting and everything else, it’s more like 9 to 9.

They know that by working just this one job, they’ll never become rich.

The Temptation of the “Get Rich Quick Scheme”

But the temptation of money, especially if it’s fast and effortless, gets irresistible.

Taking advantage of this, scammers come up with the “Get Rich Quick Scheme”.

They claim to make you rich, but the shocking truth is: that it’s the ones selling you these schemes who end up getting richer!

Ready to get awakened? Keep reading further.

What is a Get Rich Quick Scheme?

“Get rich quick schemes” are typically frauds or scams that promise you quick and huge returns with minimum risk or effort.

These schemes exploit your desire for that easy and quick money, but you end up being scammed and disappointed with LOSS.

So just to save you from these frauds and scams, let me tell you some common “Get Rich Quick Schemes” that scammers use to trick you and scam you.

Let’s unveil some common tricks these scammers use:

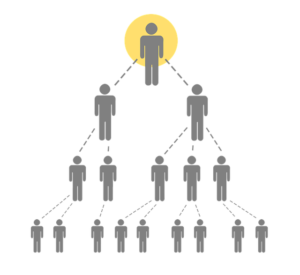

(1) Pyramid Scheme (3 लोग जोडो – Recruit More People)

Pyramid Schemes are focussed on “recruiting more and more People”.

Yes, Even MLM companies and Network Marketing use this principle which I will expose soon in another dedicated article.

Pyramid Scheme Explained

Imagine a friend of you says, “Give me 5000 rupees, and I’ll help you make it 10,000!”. But here’s the catch, you will just need to bring in more people to invest and join.

The more people you make them join, you’ll keep moving up the pyramid and more the money you’ll make.

So just after seeing the carrot your friend shows you of turning your 5000 rupees into 10,000 or even more (as claimed), you just put the money, and make 3 of your friends join the scheme or company.

Same story you tell to your friends, they to their friends, and the chain starts getting bigger.

The Collapse of the Scheme…

Now, everyone’s tempted by the idea of doubling their money or making big profits on their initial investment.

But here’s the shocker: Since this setup is unsustainable and can’t last forever, there comes a point when you or your friends can’t bring in more people.

The result? The chain breaks and the scheme collapses. The whole thing falls apart, like a house of cards.

Reality of the Pyramid Scheme

Those at the top might make lots of money by convincing others to join, but in reality, they’re the ones who profit, while the rest lose their hard-earned cash.

By showing you the carrot of higher profits aur इसकी टोपी उसके सर करके, a lot of money by all you small fishes is invested.

But in reality, only the big sharks sitting on top of the pyramid make money from all the small fish recruited.

Those in the middle and bottom of the pyramid end up losing all their money!!

Pyramid Schemes are like building a house of cards; they might look very impressive at the start, but in the end, they’re just meant to collapse.

So, stay away from such schemes, and focus on more stable and honest ways to grow your money.

(2) Ponzi Scheme (No Risk, Huge Returns)

Ponzi schemes are focused on “Investments”.

Investors are promised high returns on their investments. But just like the pyramid scheme, a Ponzi Scheme is a big money illusion painted to mint money from all the small fishes.

However, Ponzi schemes do not require the recruitment of new people. It just demands investment.

The Temptation of Huge Returns

They even pay you some of the returns at first to gain your trust.

The investment amount gets bigger and bigger with greed or the scheme criteria.

You’re tempted to make a bigger investment this time in hopes of bigger profits.

But here’s the trick…

Reality of the Ponzi Scheme

Just like the pyramid scheme, the structure is unsustainable and this can’t go on forever.

In reality, no one is making real profits. The money is just rolled over from new investors to pay the older ones (इसकी टोपी उसके सर करके).

Eventually, when there aren’t enough new investors to pay the old ones, the scheme collapses, and a lot of people lose their money.

It’s a sneaky way to trick people into thinking they’re making money when, in reality, it’s just a house of cards waiting to fall.

In Ponzi Schemes, you’re just made to put money by the operator, paid peanuts with rolling-over investments to bring in bigger investments, and the scheme collapses. In the end, you lose all your money.

Beware: Many schemes are also made by stacking the Ponzi + Pyramid model.

(3) Risk-Free, GUARANTEED Returns!!

No investment is risk-free. Even the FD you’re making in a bank involves some risk.

What if the bank shuts down? What safeguarding measures does the investment have? Though nationalized banks are often regulated by the RBI and the regulatory body.

Risk and returns always go hand-in-hand. The lower the risk, the lower the returns. The higher the risk, the higher the returns.

The Misuse of GUARANTEED RETURNS

Many scammers misuse the word “GUARANTEED” to lure and attract you for financial fraud.

They trick you into offering enormous returns (GUARANTEED) with very little or no risk involved.

You would be assured that your money is safe and your investment can double or triple quickly. They might even show you testimonials or feedback from other clients to make it look real.

Reality of Guaranteed Returns

The truth is, your money is highly at risk and all of those testimonials shown to you are fabricated and fake!

SEBI, as a regulatory authority in India, does not permit entities to offer guaranteed returns on investments, especially in the securities and financial markets.

Please Note: Investments carry some level of risk, and any claim of guaranteed returns is often a red flag for potential fraud. Never get involved in any schemes which are not regulated by national bodies.

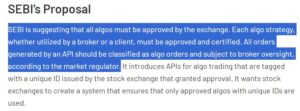

(4) Algo Trading Software

This refers to my above point. They lure you with their so-called “Low Risk – High Returns” yielding algorithm software that would not only give you enormous returns with minimal-no risk but will also give you accurate BUY & SELL levels.

That too, is automated. It’ll not only enter and exit trade automatically, but you’ll also make money without any skills or effort.

Sounds too good to be true, isn’t it? Well, this is where most people get tricked!

It’s better not to involve yourself in any third-party software that is not registered with NSE, SEBI, or any nationalized regulatory body.

(5) Work from Home Scams

Who doesn’t want to make money by sitting in the comforts of their homes? Also, most of the housewives are looking for some sort of employment or work. What can be better than WFH?

Fake data entry work, filling up online surveys, clicking ads, promoting MLM and cosmetic products, online promotional work, etc. Most of us have been here and tried it.

But just ended up being scammed.

Shockingly, They even lure you by telling you that it’s a registered or govt. affiliated work.

The Reality of Work-from-Home Jobs

Fake remote job offers are one of them that just vanishes once you pay the upfront or registration charges.

The catch behind these schemes is they often require you to pay upfront fees, purchase expensive training materials, or provide personal data.

In reality, you end up losing money rather than making any.

Note: Legit work-from-home opportunities exist, but it’s crucial to research the work/company thoroughly, avoid any upfront payments, and be cautious of such offers that seem too good to be true.

(6) The Penny Stock Scam

You might have come across many tips to buy a 2-10 rupees stock that is soon gonna skyrocket to 100-200 and multiple folds.

You might have even seen many YouTube ads recommending buying (which is illegal!!) penny stocks.

They convince you that they have insider info about a tiny, cheap stock that’s about to explode in value very soon.

Greed kicks in, you put in your money thinking that your investment will grow 5 to 10 times within no time. You’ll be filthy rich quickly.

The Reality of Penny Shares Scam

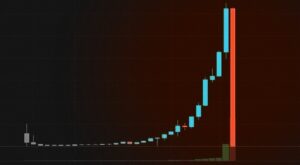

The catch in penny shares scam is “PUMP and DUMP”.

News is spread in the market about penny stocks. Many buy it, the stock price goes up due to the increase in demand.

More people buy, and the stock keeps getting pumped up.

Your greed kicks in even more, you put in more money. But the operator sitting on the top just DUMP all the stocks and guess what?

The stock crashes and you lose all the money, while the big player walks out with HUGE PROFITS!

(7) Mysterious Cryptocurrency and Trading Signals

Scammers promote fake or nonexistent cryptocurrencies, promising investors rapid gains.

They claim to have a secret formula or software that can give you accurate signals and guarantee profitable trades in the Forex and other markets (Yes, this includes the share market too).

A new cryptocurrency project is promoted as the “Next Bitcoin of Millenium” and promises massive returns for early investors.

The Irresistible Offer…

They make you an irresistible offer and charge you the service fee to give accurate buy/sell signals. They add you to their telegram and other so-called premium groups.

Decorating their offer and making it tempting for you, they would even say that don’t pay us anything. Yes, you heard that right.

Just pay us 30-50% of your profits. And that’s only and only when you make the PROFIT! Sounds tempting isn’t it?

Do not fall prey to these.

After many people invest, end of the day these scammers just ghost you eating up all your money!

Conclusion

Don’t fall for the allure of quick riches. Avoid these schemes and focus on honest and stable ways to grow your money.

Remember, wealth is built on solid foundations, not illusions.

Choose wisdom over greed, and secure your financial future.

Have you heard of or encountered any other ‘Get Rich Quick’ Scheme? Let us know in the Comments↓

Excellent article! We will be linking to this great content on our site.

Keep up the good writing.