Rich Dad Poor Dad Book Summary

Two dads, two contrary philosophies about MONEY. “Rich Dad Poor Dad” – An Amazing Financial Masterpiece written by Robert Kiyosaki and Sharon Lechter published in 1997.

Since then, the book has become a bestseller and has sold millions of copies worldwide.

Kiyosaki shares his personal experiences with his two fathers i.e. his biological father (which he refers to as poor dad) and his best friend’s father (rich dad).

His real father was a professor who earned a lot, yet always struggled financially. While his friend’s father (rich dad), an entrepreneur who dropped out of school at an early age ended up as one of the richest people in Hawaii.

Kiyosaki often tried to understand the perspective of both his fathers, but his rich dad’s advice is what helped him gain financial education at the very early age of 9 and acquire wealth over time.

He explains that his poor dad believed in the traditional path of education, getting a degree, and a job, while his rich dad believed in creating wealth through entrepreneurship and investing in wealth-generating assets.

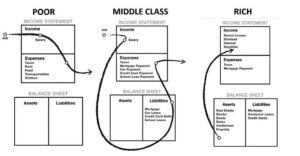

This book guides us on the importance of financial literacy and wealth generation from an early age. It explains how a person can be wealthy just by creating assets instead of liabilities.

It introduces and simplifies the concepts of cash flow, balance sheet, income statement, assets, and liabilities.

The author wishes that everyone learns about finances from a young age, inspiring this book to educate all on wealth generation and money management.

This was my first Audiobook that I listened.

Rich Dad Poor Dad has 10 chapters plus the introduction, but much of the book focuses on the first 6 lessons. Let’s dive right into the detailed explanation of the book!

Chapter 1: Rich Dad Poor Dad – Introduction

The Introduction highlights the contrasting views between Robert’s rich dad and poor dad, as it shows both of their perspectives on money and wealth.

Robert Kiyosaki’s intelligent and well-educated father, “Poor Dad,” believed in studying hard, getting good grades, and then finding a high-paying job. However, despite his positive traits, he did not achieve financial success.

Rich Dad, the father of Kiyosaki’s friend, believed in financial education that schools don’t teach. He learnt how money works and how he can make money work for him.

He created his wealth through entrepreneurship and investing in assets like stocks, bonds, intellectual properties, and real estate, despite not finishing school and making money work for him.

Chapter 2: Riches Don’t Work for “Money”

The rich do not work for money. Instead, they make money work for them. How? They learn about Finance, they learn about money, cash flow, assets & liabilities, and understand how money works.

Rich dad believed in making money work for them through investments and entrepreneurship, rather than relying solely on a single job income. However, investments are not a “Get-Rich-Quick Scheme”.

As per him, having a regular job is just a short-term solution, but not a long-term way to become rich and achieve financial independence.

“It’s the fear, greed, and ignorance that keeps most people doing a job forever. These emotions keep people trapped in jobs they hate and dislike.”

The fear of not paying their bills, the fear of being fired, the fear of not having enough money, the fear of starting a business (as they think it is highly risky), and the fear of starting over everything from scratch.

People have different prices which are given to them in the form of salary.

So they just settle down for that deal price given to them due to the fear and continue to stay in that vicious cycle for the rest of their lives.

They become a slave to money—and then get angry at their bosses.

This is why they never go the entrepreneur way and make it big.

Chapter 3: Why Teach Financial Literacy?

Kiyosaki argues that financial literacy is not taught in schools which has led to a lack of knowledge about finances and money among most people.

It’s not about how much money you make, but about how much money you keep.

It explains the difference between an Asset and a Liability, which is very important to make money work for you. “Build Assets, Not Liabilities”.

“An Asset” is something that puts money in your pocket. While “A Liability” is something that takes money out of your pocket. Assets produce income and they always appreciate. While the liabilities do the opposite.

Want to grow rich? Put your efforts into buying income-producing assets keeping your liabilities and expenses low. This way you will make your assets column stronger.

Chapter 4: Mind your own business

Just focus on creating assets, such as businesses, investments, and intellectual properties that generate income.

The only rule, and the most important one: You need to know about ASSETS & LIABILITIES and just focus on building assets that would make money for you.

Make money for yourself, not for your employer. Have an employer mindset and mind your own thing. Keep building and keep growing.

Re-invest in your buying more assets so that both, your assets and your income keep growing over time.

Chapter 5: The History of Taxes and the Power of Corporations

The wealthy understand the power of company structures and taxes and use all legal means possible to reduce their tax burden.

They have a lot of knowledge about taxes, which they use to minimize their taxes and continue to make more money.

When comparing how business owners and investors with corporations such as C corps, S corps, or LLCs pay taxes to how most people pay tax, The clear difference is:

Business Owners with a Corporate Structure:

1. Earn

2. Spend

3. Pay taxes

Employees who work for Corporations:

1. Earn

2. Pay taxes

3. Spend

Employees spend their money after taxes, while business owners earn and spend before paying taxes.

For eg, a corporation can pay expenses before paying taxes, whereas an employee gets taxed first and must pay expenses on what is left.

According to Kiyosaki, understanding the tax system and using corporations effectively can help people achieve financial freedom.

By understanding the tax code and the legal system, the rich stay one step ahead of the systems designed to control them. The system is the matrix in which we are trapped.

To break free from the matrix and be ahead of the rat race, we must understand taxation and its legalities. The wealthy use the tax system to their advantage.

Chapter 6: The Rich Invent Money

The rich invents money by creating innovative products and services that solve problems and meet people’s needs.

They grow their money by investing in stocks, bonds, gold, etc. and create multiple income sources for them.

The author believes that everyone is born with talent, but it gets suppressed by blindly following the rat race and self-doubt.

Fear and comfort discourage people from taking risks and creating opportunities.

Wealth creation requires proactive measures, and Kiyosaki suggests leveraging creativity and innovation to provide value in the market. This will lead to financial prosperity.

Chapter 7: Work to Learn—Don’t Work for Money

Focus on learning. Read books, listen to audiobooks, and learn skills that you’re interested in before getting into the rat race.

Here are top High Income Skills to Earn Money Online in 2023.

“Job security meant everything to my educated dad. But Learning meant everything to my rich dad” – Kiyosaki says.

It’s crucial to prioritize learning over earning if you want to become wealthy.

Kiyosaki explains that the rich are constantly learning and developing new skills, and this is what allows them to create wealth in the long term.

They sacrifice their short-term treats and incentives and focus on the big long-term rewards.

Chapter 8: Overcoming Obstacles

Robert Kiyosaki explains the Top 5 reasons why even financially educated people may struggle to create assets that generate cash flow.

This is because they face these obstacles when they start walking on the path of financial freedom.

(1) Fear:

They fear risk and failure. To overcome fear, one must learn how to manage it and accept failures. But as per him, losers avoid failing, while failure turns losers into winners.

(2) Cynicism:

Cynicism is the ‘feeling that things aren’t going to work out well’. The best way to defeat cynicism is to analyze it. By doing so we would identify opportunities that critics most likely miss!

(3) Laziness:

Instead of being a lazy bum, one should constantly learn and look out for solutions that benefit them.

(4) Bad habits:

Habits decide your behaviour. They either make you or break you. Most people pay their bills and spend & spend first before they save up anything. They’re hardly left with anything this way.

You just need to do the opposite. Paying yourself first and this will make you financially and mentally stronger. Reverse psychology comes into play here.

When you develop the habit of paying yourself first, you become motivated by the fear of not being able to pay the bills and the debts.

This motivation fuels us to work harder and smarter making us seek other forms of income like investments, real estate, stocks, bonds, etc.

(5) Arrogance:

Just realize your mistakes, accept your ignorance, and educate yourselves about it. Arrogance needs to be dealt with this way!

If you discover you’re ignorant about a subject, educate yourself or find an expert in the field.

He suggests cutting out negative people and their fears from your life.

Always keep learning and constantly seeking what’s there at the table for you. Overcoming these challenges is crucial to enormous personal and financial growth.

Chapter 9: Getting Started

From a young age, most of us have been trained to work hard for someone else, spend the money we earn and borrow it if we run short.

Unfortunately, this way of living doesn’t help us develop our “Financial Genius”. The gold is all around us, but we have been conditioned not to see it.

Here are the 10 steps to follow to build your financial genius and discover that gold which is already out there:

(1) Have a strong purpose and find a greater reason. Know what you want and don’t want in life, and set your priorities accordingly.

(2) Have the power of choice and make choices based on your priorities. Every day, choose what to do and what not to do. Your choices determine how you use your time and money.

(3) Choose your friends wisely. Surround yourself with rich friends who can teach you about money.

Be selective in your associations, and don’t take financial advice from poor or fearful people.

(4) Learn how to make money and quickly develop your formula.

(5) Pay yourself first and be disciplined with managing your cash flow.

(6) Build a great team of people around you, and compensate them generously for their work.

(7) Always ask yourself, “How fast can I get my money back?”. Consider the return on investment and how quickly you can get back your investment.

(8) Invest in money-generating assets, and use them to buy luxuries instead of directly spending on liabilities.

(9) Be a giver. If you want to receive things you want, you need to be a kind giver to the society.

(10) Have a mentor or a role model and utilize their genius mind to prosper.

Chapter 10: Still Want More? Here Are Some To Do’s

The author provides readers with actionable steps and “To-dos” to apply in their lives. These steps include:

1. Stop following the crowd and figure out what works best for you.

2. Keep learning by attending classes, courses, and seminars and use all your resources to gain new knowledge and ideas.

3. Find a mentor who has achieved what you want to achieve and learn from them. You can even take them out for lunch and spend time with them to gain insights.

4. Look for real estate deals when the market corrects because profits are made when buying, not when selling. If you hate real estate, don’t invest in it.

5. Think big to become rich because small thinking won’t get you there.

6. Study history because it always repeats itself and you can learn from it.

7. Take action because it beats inaction every time.

8. Invest in educating your mind as it is your biggest asset.

My POV

As soon as I listened to this Audiobook a while back, I couldn’t express how relatable it was for me.

I found myself resonating deeply with the author’s words, as they mirrored many of my own beliefs.

After listening to this I was glad that I’ve an open mindset of an entrepreneur. This book just reaffirmed my entrepreneurial mindset.

When it comes to education, I prioritize skills over formal education. I’ve never wanted a regular job; I aspire to work for myself and contribute to society.

This is why I continuously learn new skills and master my existing ones.

I educate and share my learning with you all too so that it can create an impact, change, and an enlightenment in the society.

This blog is also my intellectual property that I created, an asset that will potentially generate income for me in the future.

This book even taught me some new things that how the wealthy people establish and run companies to manage and escape paying taxes smartly, which aids in their financial growth.

I actually prefer audiobooks over reading and hearing the Hindi version also compelled me to order a physical copy of it.

For those interested, here’s the FREE E-Book version to read it on your mobile. And if you’d like a hardcopy, you can order it from Amazon (affiliate link).

↓Rich Dad Poor Dad Free E-Book↓

Sharing is Caring

You should take part inn a contest for one of the finest blogs on the internet.

I am going to highly recommend this web site!